Coronavirus makes eCommerce fly

Rapidly online purchases have turned from a whim into a necessity, causing the collapse of technological and cultural barriers. Self-isolation has led consumers to digitally seek the answer to their supply and entertainment needs, leading to a significant increase in the online purchases – equal (or perhaps even bigger) to the peaks of special days such as Cyber Monday or Black Friday.

Citizens’ purchase priorities are changing. What do buyers expect now?

Surely a user experience that allows them to have clear costs and timing of shipping already in the purchase phase is essential, as well as the added value of same-day deliveries and schedulable in time slots according to customers’ needs. These are aspects that allow the consumer to replicate the shop experience and that ease hesitancy about shopping online represented by anxiety and uncertainty.

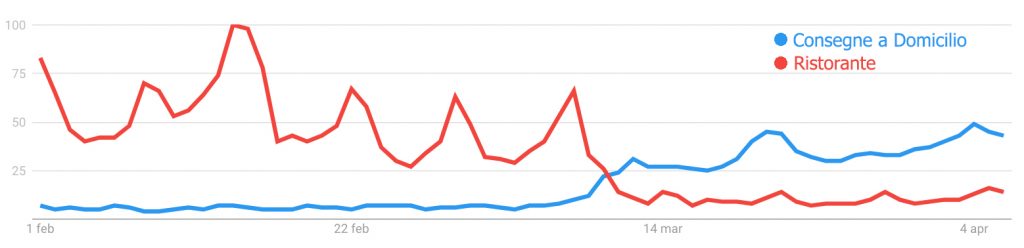

The web helps us understand and interpret this new trend. With searches for the keyword “home shopping” and “home delivery” in the last 7 days on Google increased by 400%, Italian people send a clear message: “please make it possible for us to stay at home”.

How do most involved production sectors react?

Resulting from an unexpected increase in the online demand, the logistics sector is multiplying its resources to meet the constantly growing requests, actively contributing to limiting the movement of people.

Logistics is resilient and stands up to the impact of Covid-19: the circulation and distribution of goods, especially primary goods, cannot stop in this critical moment.

In the fight against virus, couriers also take on the new and unusual role of heroes: every day on the front lines they continue to guarantee a service that has now become essential. Technology is a useful tool, that allows to develop new solutions for the last mile logistics, offering the possibility of organizing deliveries to affiliated drop-off points.

The concern of consumers has also caused a double-digit growth in sales of large-scale distribution, which in the week between Monday 24th February and Sunday 1st March recorded a strong growth trend compared to the same week of 2019, with an increase of 12,2%.

Food Home Delivery remains in most cases an option which, if previously perceived as added value, now represents a primary service.

But what other alternatives to home delivery do large supermarket chains offer?

The click & collect option, which recorded an increase of + 205.4% compared to the previous year; the possibility of shopping by phone, email or WhatsApp; the collection of online orders at a shop & drive (directly in the car’s trunk) or at a locker.

Moreover, many chains have decided not to charge for the delivery, also adding an extension of the kilometric radius to guarantee the service even to customers in remote areas.

The graph shows the difference in search volumes in Italy between “home deliveries” (in blue) and “restaurant” (in red). From these data is evident the increase in the request of delivery services, a sign of how the emergency has changed consumption habits.

For other sectors, such as the fashion & beauty sector, the keyword is “conversion”.

Let’s think about the clothing sector, which in 2019 represented about two thirds of product exports: today it is an excellent example of versatility. Many brands have converted their production in favour of dressing gowns and surgical masks; in the same way also some perfume and cosmetic laboratories are encouraging the production of hand and home sanitizers.

Which predictions for the future?

Once the emergency is over, it is highly likely that new balances will develop in the world of tomorrow: the break-through of e-commerce on the total of Retail, historically lower in Italy than in the rest of Europe, will be suddenly projected into a new era. We will enter a phase in which it will be necessary to manage peaks of volumes without perceiving them as anomalies or emergencies. Companies will have to accelerate their digitalization and keep ready. The differences between online and offline will be flattened, creating a single offer that can easily move from one channel to another.

We are facing an unprecedented crisis in terms of depth and geographical extention which somehow puts operators in front of the need to renew physical retail, giving new awareness of the opportunities that the digital channel offers.

Data sources:

https://triboo.com/

https://www.nielsen.com/it/it/

https://blog.milkman.it/

https://ecommercemonitor.it/

Osservatorio eCommerce B2c Netcomm – Politecnico di Milano